HDFC UPI Not Working: Best Solutions (100% work)

Unified Payments Interface (UPI) has revolutionized the digital world of payments in India by allowing immediate as well as seamless payments. HDFC Bank, as one of the most reputable financial institutions, provides UPI services via its mobile banking apps and collaboration with third-party applications. However, customers may have difficulties when using HDFC’s UPI services. This article examines the possible causes that cause these problems and offers solutions to make sure that transactions are smooth.

Common Reasons for HDFC UPI Not Working

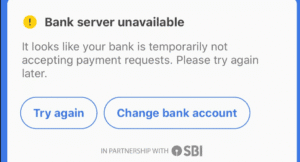

- Server down time The scheduled maintenance or unanticipated technical glitches could result in temporary disruption of HDFC’s UPI services. This can cause disruption to the transactions on all UPI platforms that are linked with HDFC accounts.

- Low Internet Connectivity A stable internet connection is essential in UPI transactions. Insecure or weak connectivity could delay the process of transaction which can cause delays or failures.

- Unintentionally entered UPI PIN Incorrectly entering a UPI PIN in a transaction could hinder its completion. Ensure that the correct PIN is entered is essential to ensure successful transactions.

- Exceeded Limits on Transactions: HDFC imposes daily limits on transactions on UPI services. Excessing these limits could cause a failure of the transaction. It’s crucial that you are aware of the limitations to be able to manage transactions efficiently.

- Versions of the application that are out of date If you are using an outdated version of the UPI application can cause issues with compatibility, which can lead to transactions being unable to complete. Regular updates ensure that the app runs at its best with the most current security features.

- Bank Account Problems Issues relating to the linked bank account like account freezes or improper linking, could hinder UPI transactions.

Solutions to Address HDFC UPI Issues

- Verify Server Status Before you initiate an order, make sure that the HDFC’s UPI services are working. Check HDFC’s official website, or call customer service for updates in real-time.

- Ensure a Stable Internet Connection Check that your device is connected to an internet connection that is reliable. Switch between Wi-Fi and mobile data to find the most reliable alternative.

- Verify your UPI PIN Verify that you input the correct UPI PIN in transactions. If you’ve forgotten your UPI PIN Use the app’s “Forgot PIN function to reset the password safely.

- Monitor Limits on Transactions Take note of HDFC’s UPI limit on transactions to make sure you do not exceed the limits. You should plan your transactions in order to remain within the limits.

- Upgrade to the UPI Application: Regularly make sure you update your UPI application to the most recent version to take advantage of enhanced features and security improvements. Go to your Google Play Store or Apple App Store to look for updates.

- Verify the Bank Account Linking Check the bank account you have is properly tied to the UPI application. If the issue persists, think about linking the account again or calling customer support to get assistance.

User Feedback on HDFC UPI Services

Positive Feedback:

- Convenience A lot of users love the ease of making transfers using HDFC’s UPI services, which highlights the easy-to-use interface of the mobile banking application.

- Integration Users appreciate an easy integration between several bank accounts on one platform, allowing for effective financial management.

Negative Feedback:

- Transaction Problems Some users have reported experiencing problems with transactions, mainly during peak hours or downtimes. This can lead to frustration.

- Application Performance There are a few concerns about the app’s performance, such as the slow loading time and frequent crashes, which can affect users’ experience.

Steps to Register a Complaint

If there are issues users may file complaints using the below channels:

- Utilizing The UPI App A majority of UPI apps include a Help” or “Support” section inside the application. Go to this section to complain about any issues or to make complaints.

- Support for Customers Contact HDFC’s Customer support via their toll-free phone number 1800 102-9426. The number is available 24 hours a day for assistance.

- branch visit Go to the nearest HDFC Bank branch to speak directly to a representative who will help you resolve UPI-related problems.

Preventive Measures for Seamless UPI Transactions

- Regular Updates to Apps Make sure you keep your UPI application up-to-date to the most recent version to guarantee optimal efficiency and safety.

- Secure Internet Connection: Make use of a stable and secure internet connection to avoid transaction failures because of connectivity issues.

- Monitor Activity on your Account You should regularly check your bank statements as well as UPI transactions to find out the discrepancies and then report them immediately.

- Avoid peak hours If you can you can conduct transactions outside of peak hours to decrease the chance of issues with servers.

- Stay informed Be aware of any scheduled maintenance schedule or problems regarding HDFC’s UPI products by checking regularly official communication via the banks.

Conclusion

Although HDFC’s UPI services provide a simple platform for transactions via digital channels, occasionally problems can arise due to many causes. By identifying the most common issues and applying the suggested solutions, customers can improve their experience when they use the service.

Average Rating